a. Open the Portfolio Tab

Go to: https://beta.positions.finance/portfolio/ Here, you’ll see:- Current Balance: Total value across all deposits and borrowings.

- Total Deposits: Combined value from Vaults and Lending Pools.

- Total Borrowings: All active borrow positions (Borrowing + Looping).

- Net APY: Your overall performance (positive or negative) after fees.

- Portfolio LTV: Weighted Loan-to-value ratio across all collateral.

- Health Factor: A live indicator of risk level (color-coded meter).

A Health Factor below 1.0 means you are eligible for liquidation. Try to stay above 1.5 for safety.

b. Track Your Deposits

Under Your Deposits, you’ll see:- Which vaults and lending pools your assets are in.

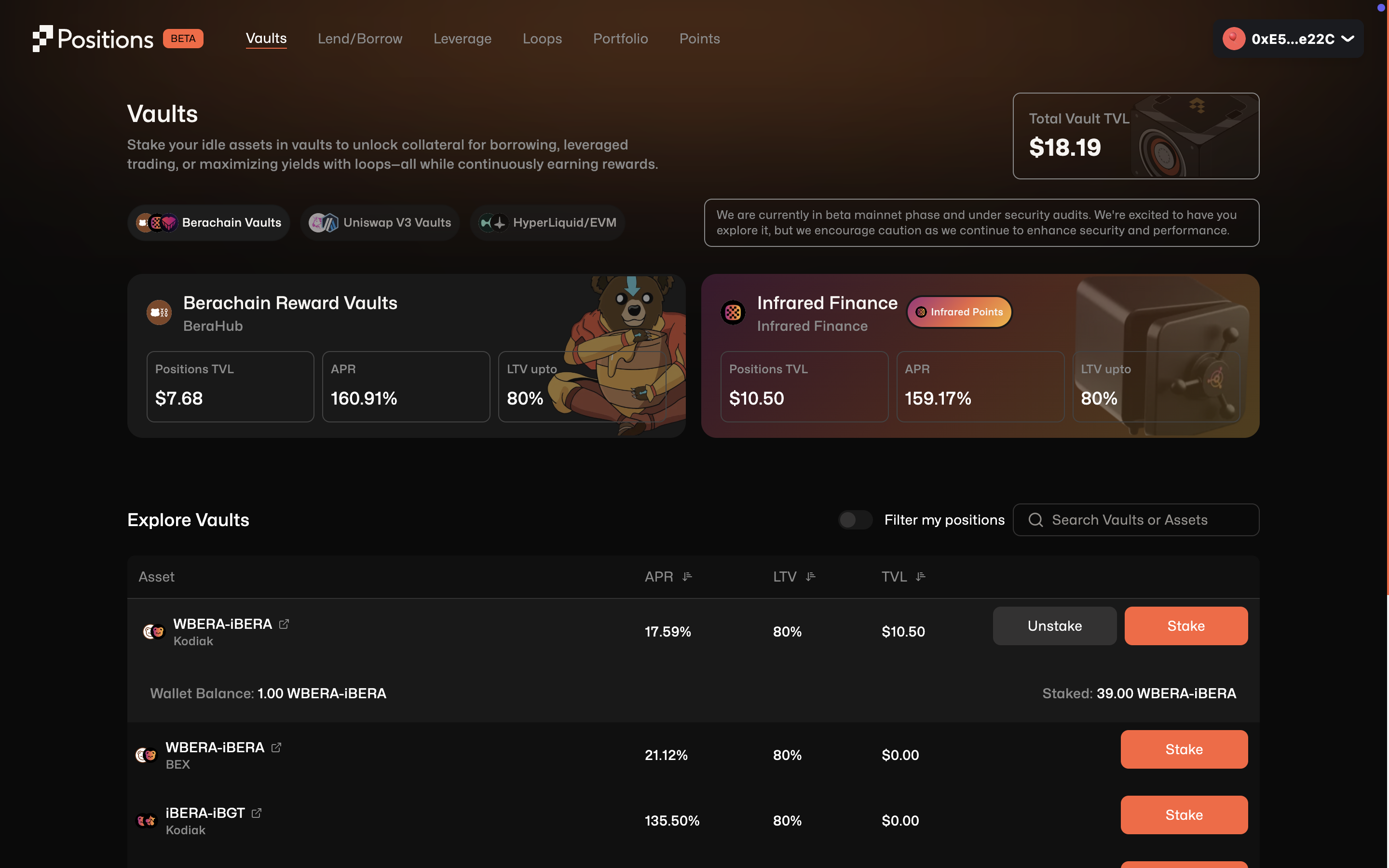

- Asset names and source vaults (e.g., Infrared Finance, Berachain Reward Vaults).

- The APY you’re earning.

- Claimable rewards per position.

In your dashboard:

- You’ve staked iBERA-wBERA in Berachain Reward Vaults at 18.89% APY.

- You’ve also staked WBERA-iBERA in Infrared at 4.5% APY.

c. Track your Borrowings

Under Your Borrowings, view:- The assets you’ve borrowed.

- The amount borrowed.

- The interest accured from borrowed liquidity.

- Options to repay or unwind via the Repay path.

d. Monitor and Adjust

Use the dashboard to:- Track overall performance (Net APY may go negative if borrow rates exceed earn rates).

- Avoid liquidation risks by repaying, withdrawing excess borrow, or adding more collateral.

- Check your PoC (Proof-of-Collateral) status directly from the dashboard or click “View more on PoC”.