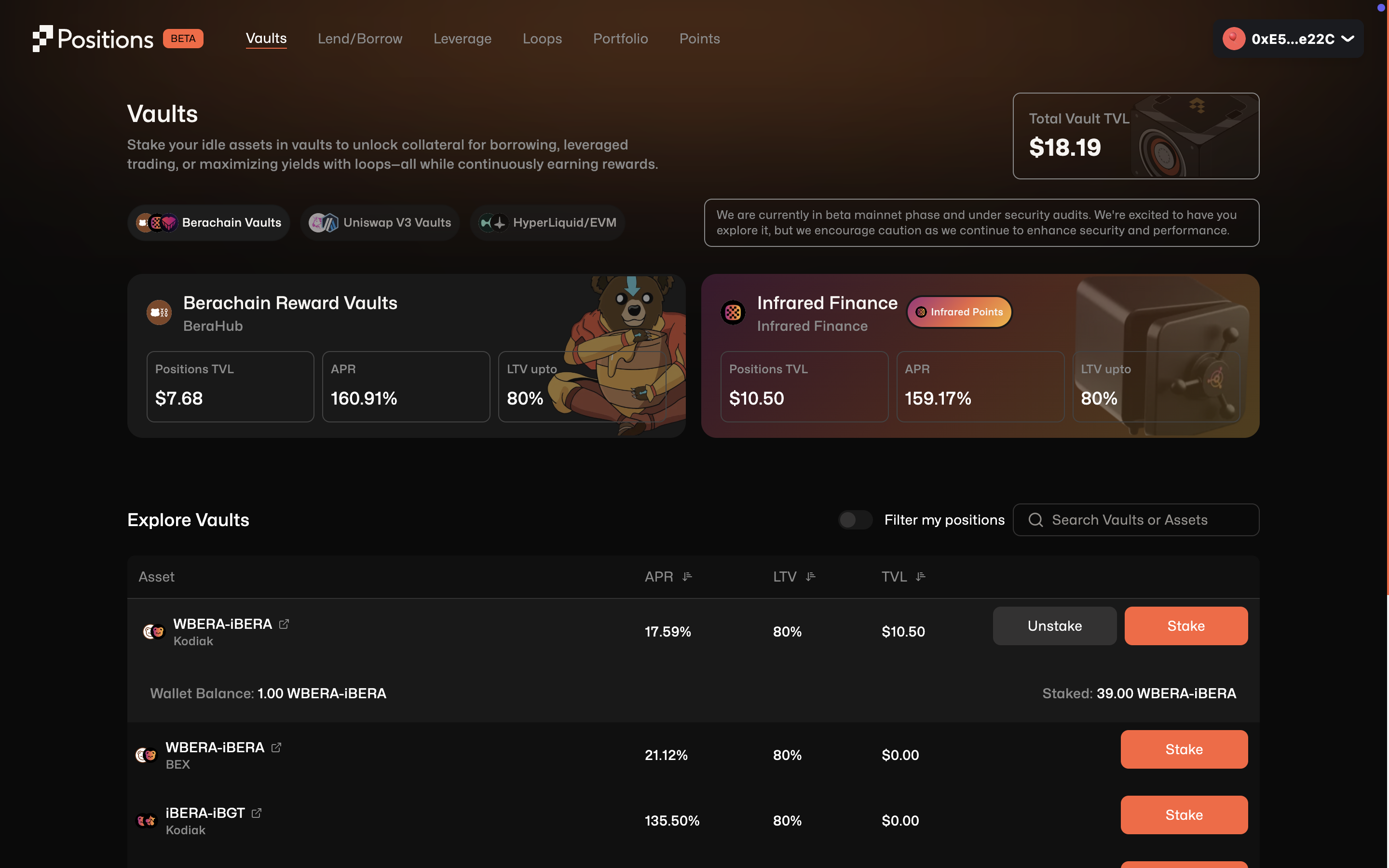

Step 1: Go to the Lending Page

Navigate to: https://beta.positions.finance/lend-borrow Here, you’ll see all available markets where you can:- Supply assets

- See real-time Supply APY

- Track pool utilization rates

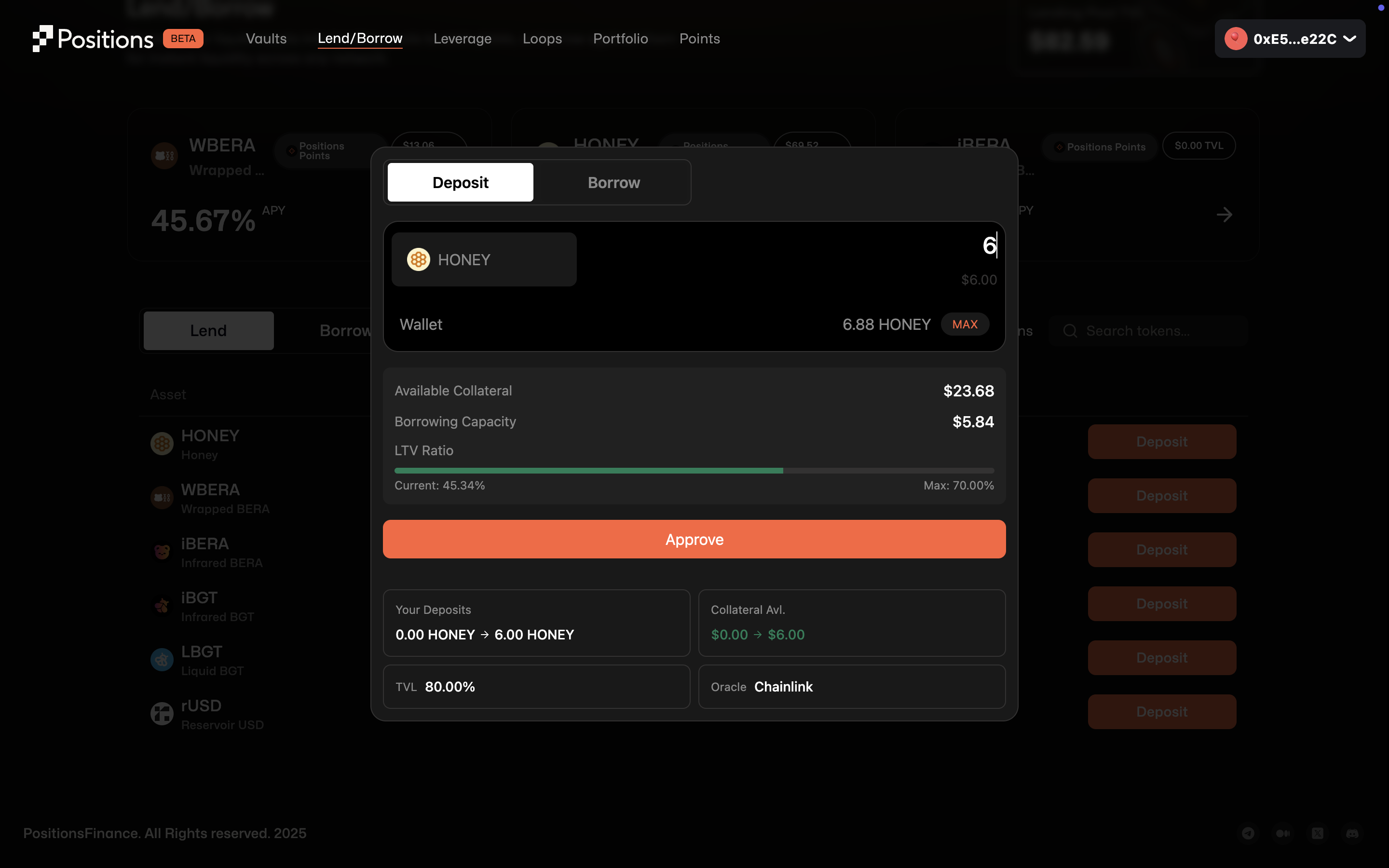

Step 2: Deposit an Asset

- Connect your wallet

- Select an asset (e.g.,

HONEY,WBERA,USDCetc.) - Click Deposit

- Enter the amount and confirm the transaction

- Your assets are deposited into the lending pool

- You begin earning interest immediately

- Your position is tracked under Portfolio → Supply

How Yields + Collateral Work

- The Lending APY comes from borrowers who pay to borrow the assets you lend.

- Interest is distributed pro-rata to all lenders.

- You also unlock collateral value to borrow against

- The rate is dynamic and depends on utilization (higher borrowing = higher yield).

What You Can Do Next

After supplying:- Borrow from your available collateral

- Loop your position for amplified yields

- Track interest and collateral health under Portfolio

- Withdraw anytime, subject to pool liquidity

Tip: High utilization or low liquidity may temporarily restrict instant withdrawals — plan accordingly.